Table of Contents

Introduction

- Imagine yourself enjoying the luxury of a first-class ticket valued at $200,000 without spending a dime. It may seem like a far-off dream, but with the right travel credit card, it can become a reality.

- Amidst the plethora of information available online about the best travel credit card in Canada, much of it is convoluted and confusing. This guide aims to simplify the complexities and provide readers with clear, straightforward insights into choosing the best travel credit card for their needs.

- By reading this guide, users can gain the knowledge and tools necessary to evaluate and compare different travel credit cards effectively. Armed with this information, they’ll be empowered to make informed decisions that can potentially save them significant amounts of money on their travels.

Understanding Travel Credit Cards

- Credit cards designed specifically for travel provide a plethora of perks and advantages. From earning points on purchases to accessing exclusive perks like free checked luggage and airport lounge access, these cards can enhance your travel experience.

- Understanding how travel credit cards work is crucial for maximizing their benefits. By utilizing the right card for your spending habits and travel preferences, you can unlock significant savings and rewards.

- Choosing the right travel credit card involves considering factors such as annual fees, rewards structure, and additional benefits like travel insurance. By researching and comparing different options, you can find the card that best suits your needs.

How To Use a Credit Card

An amount of money that has been pre-approved can be borrowed using a credit card. You may be able to pay for products or services using it. Your minimum payment must be made by the due date when using a credit card. Typically, the credit card issuer assesses interest fees if the balance is not paid in full.

Making use of a credit card is really simple. To make your life simpler, just keep in mind a few crucial points. Paying down your amount on time each month is the first rule: never spend more than you can afford. It may also be beneficial for you to comprehend how credit scores are calculated in the long run.

Make sure the credit card you select for your first credit card—or any card for that matter—fits your requirements and circumstances. If you’re just starting out and need to establish your credit history, secured and student cards are ideal choices.How To Use a Credit Card

Essential Considerations for Choosing a Travel Credit Card

- Eligibility Criteria: Before applying for a travel credit card, ensure you meet the issuer’s eligibility criteria, including age, residency status, credit score, and income.

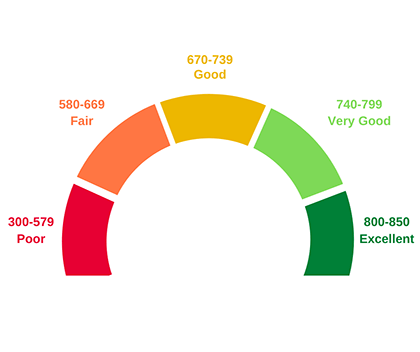

- Credit Score Range: Most lenders use the FICO model, which ranges from 300 to 850, to assess creditworthiness. Understanding where you fall within this range can help you determine which cards you’re eligible for.

- Types of Travel Credit Cards: From co-branded airline and hotel cards to cash back options, there’s a wide range of travel credit cards available. Choose the type that aligns with your travel preferences and spending habits.

Requirements for obtaining a travel credit card

To get a travel credit card, the company you’re applying to will ask for some basic requirements. These might include things like your age, where you live, how good your credit is, and how much money you make.

Each province has its own age limit for applying.

| Province or territory | Age of majority |

| Alberta | 18 |

| British Columbia | 19 |

| Manitoba | 18 |

| New Brunswick | 19 |

| Newfoundland and Labrador | 19 |

| Northwests Territories | 19 |

| Nova Scotia | 19 |

| Nunavut | 19 |

| Ontario | 18 |

| Prince Edward Island | 18 |

| Quebec | 18 |

| Saskatchewan | 18 |

| Yukon Territories | 19 |

Credit scores needed to get travel credit cards

In Canada, there are primarily two credit bureaus:

- Equifax

- TransUnion

These entities are private organisations tasked with the collection, storage, and distribution of information pertaining to your credit usage. Credit scores range from 300 to 850. Here’s what this scale signifies:

- Poor: Scores from 350 to 579

- Fair: Scores from 580 to 669

- Good: Scores from 670 to 739

- Very good: Scores from 740 to 799

- Exceptional: Scores from 800 to 850

How does a travel credit card work?

Perks associated with travel credit cards include access to airport lounges, bonus points for expenditures made during the journey, and elite status. Users earn points or miles with each purchase, redeemable for flights, hotels, or other travel expenses. It’s crucial to maximize card benefits, especially with higher annual fees. This includes using complimentary travel insurance, concierge services, and booking discounts. Overall, travel credit cards enhance the travel experience, making them popular for frequent travelers seeking to maximize benefits.

Types of travel credit cards in Canada

- Cobranding Travel Credit Cards: In Canada, cobranding travel credit cards are tailored to specific travel preferences, offering unique rewards and perks. These cards are often associated with airlines or hotel chains, providing benefits like priority boarding, free upgrades, and bonus points on travel purchases.

- Flight Cards: Designed for frequent flyers, flight-focused credit cards in Canada offer benefits such as airline credits, priority boarding, lounge access, and extra miles. They’re perfect for those who travel by air often and want to make the most of their journeys.

- Hotel Cards: Canadian hotel credit cards come with perks like complimentary nights, room upgrades, late check-outs, and exclusive hotel amenities. They’re great for travelers seeking comfort and luxury during their hotel stays.

- Points Expiry: It’s essential to keep track of your points or miles’ expiration dates, as many reward programs have strict policies. Unused points may expire if not redeemed before the expiration date.

- Example: Aeroplan® Credit Cards showcase the diverse range of offerings available in Canada, providing rewards and benefits tailored to air travel and hotel stays alike.

How do I choose a travel credit card?

- Fee Evaluation: Before choosing a travel credit card, it’s crucial to understand the fees involved. Look into the card’s annual fees, markup fees for currency conversion, and any charges for foreign transactions. Being aware of these fees helps you estimate the overall cost of using the card while traveling.

- Rewards Evaluation: Pay close attention to the card’s rewards program. Consider how you earn rewards, whether it’s through points, miles, or cash back. Additionally, check if the card provides travel insurance coverage and other perks like access to airport lounges or special discounts on travel-related purchases.

- Benefit Analysis: Beyond rewards, explore the extra benefits provided by the card. These could include travel insurance, upgrades at hotels, or rental car insurance. Assessing these benefits helps you determine the overall value the card offers and whether it aligns with your travel needs and preferences.

By carefully examining these aspects, you can choose a travel credit card that not only helps you earn rewards but also provides valuable benefits and keeps fees to a minimum, ensuring a smooth and rewarding travel experience.

Recommended Travel Credit Card in Canada

- For Beginners: Consider options like the Cashback World Elite Mastercard or American Express Aeroplan Reserve for their attractive joining bonuses and rewards structure.

- For Business: Explore cards like the TD Aeroplan Visa Business Card or American Express Aeroplan Business Reserve Card, which offer enhanced earning potential and benefits tailored to business travelers.

- No Annual Fee Options: If you’re looking to avoid annual fees, cards like the CIBC Aeroplan Visa Card or Scotiabank American Express Card offer competitive rewards without the upfront cost.

List of Best Travel Credit Card in Canada

| Card Name | Annual Fee | Joining Bonus | Interest Rate | Earning | Where to Redeem Points |

| Cashback World Elite Mastercard | $120 | 10% cash back for the first 3 months | Variable APR | 5% cash back on groceries 4% cash back on transit 3% cash back on gas 2% cash back on recurring bills 1% cash back on all other purchases | Cash back can be redeemed as statement credit or deposited into a bank account |

| American Express Aeroplane Reserve | $599 | 85,000 points with spending requirements | Variable APR | 3 extra points per dollar spent on Air Canada 2 extra points per dollar spent at restaurants 1.25 extra points for all other purchases | Points can be redeemed for flights, upgrades, and other travel expenses |

| American Express Platinum | $699 | 80,000 points with spending requirements | Variable APR | 3 extra points per dollar spent at restaurants 2 extra points per dollar spent on travel 1 extra point per dollar spent on eligible hotel and rental car bookings | Points can be redeemed for travel, merchandise, or transferred to partner loyalty programs |

| TD Aeroplan Visa Infinite Privilege Card | $599 | 105,000 points with spending requirements | Variable APR | 2 extra points per dollar spent on Air Canada purchases 1.5 extra points for eligible gas, grocery, travel, and dining purchases 1.25 extra points for all other purchases | Points can be redeemed for flights, upgrades, and other travel expenses |

| Student Cashback | $0 | Up to $100 for the first 3 months | Variable APR | 3% cash back on eligible grocery purchases 1% cash back on eligible bill purchases 0.5% cash back on all other purchases | Cash back can be redeemed as statement credit or deposited into a bank account |

| American Express Cobalt | $155 | 30,000 points with spending requirements | Variable APR | 5 times the points on drinks three times the points on streaming services 2 times the points on travel and transit 1 extra point on all other purchases | Points can be redeemed for travel, merchandise, or transferred to partner loyalty programs |

TD Aeroplan® Travel Credit Cards

| Card Name | Annual Fee | Joining Bonus | Interest Rate | Credit Score | Earning |

| TD® Aeroplan® Visa Platinum* Card | $89 | N/A | Variable APR | Good to Excellent | 1 point per $1 spent |

| TD® Aeroplan® Visa Infinite* Card | $139 | N/A | Variable APR | Good to Excellent | 1.5 points per $1 spent |

| TD® Aeroplan® Visa Infinite Privilege* Card | $599 | N/A | Variable APR | Good to Excellent | 2 points per $1 spent |

| TD® Aeroplan® Visa* Business Card | $149 | N/A | Variable APR | Good to Excellent | 2 points per $1 spent |

American Express® Aeroplan® Travel Credit Cards

| Card Name | Annual Fee | Joining Bonus | Interest Rate | Credit Score | Where to Redeem Points |

| American Express®* Aeroplan® Reserve Card | $599 | Up to 90,000 Welcome Bonus Aeroplan points.1** | 20.99%* | Good to Excellent | Points can be redeemed for flights, upgrades, and other travel expenses |

| American Express®* Aeroplan® Card | $120 | Up to 40,000 Welcome Bonus Aeroplan points.1** | N/A | Good to Excellent | Points can be redeemed for flights, upgrades, and other travel expenses |

| American Express®* Aeroplan® Business Reserve Card | $599 | Up to 95,000 Welcome Bonus Aeroplan points.1** | 19.99%* | Good to Excellent | Points can be redeemed for flights, upgrades, and other travel expenses |

CIBC Aeroplan® Travel Credit Cards

| Card Name | Annual Fee | Joining Bonus | Interest Rate | Credit Score | Earning |

| CIBC Aeroplan® Visa* Card | $0 | Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card.1 Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of your account opening. | Variable APR | Good to Excellent | 1 point per $1 spent |

| CIBC Aeroplan® Visa Infinite* Card | $139 | Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card. Earn an additional 20,000 Aeroplan points when you spend $5,000 within 6 months of your account opening. Get an anniversary bonus of 10,000 Aeroplan points when you spend $7,500 in the first 12 months. | Variable APR | Good to Excellent | 1.5 points per $1 spent |

| CIBC Aeroplan® Visa Infinite Privilege* Card | $599 | Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card within the first 3 months. Earn up to 24K points (2K points with $2,500 spent each month for the first 12 months). Plus, earn up to 5,500 Aeroplan points for the first PAP registration and an additional 5,500 for the second PAP registration. | Variable APR | Good to Excellent | 2 points per $1 spent |

| CIBC Aeroplan® Visa* Business Card | $180 | Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card. Earn an additional 20,000 Aeroplan points when you spend $5,000 within 6 months of your account opening. Get an anniversary bonus of 10,000 Aeroplan points when you spend $7,500 in the first 12 months. | Variable APR | Good to Excellent | 2 points per $1 spent |

The best travel Card in Canada has no annual fee

Experience the joy of traveling without worrying about pesky annual fees with our top picks for no-annual-fee travel credit cards. These cards make it easy to earn travel rewards and enjoy special perks without any extra costs eating into your budget. Whether you’re earning points on everyday purchases or unlocking exclusive travel benefits like lounge access and insurance, these cards offer incredible value without the hefty price tag. Say goodbye to annual fees and hello to stress-free travel rewards! For more details on the best no-annual-fee travel credit cards in Canada, check out our blog. Read more.

The Best Credit Card for Travel Points in Canada

Find the top-notch travel buddy with the finest credit card for collecting travel points in Canada. Whether you travel often or just sometimes, this card gives you amazing benefits. Earn points easily on everything you buy, unlocking special rewards like free flights and hotel stays. With easy ways to use your points and great welcome bonuses, turning your everyday shopping into an exciting travel experience is simple. With the top credit card for travel points in Canada, you can bid farewell to travel-related concerns and hello to boundless excursions. Get ready for your next trip with confidence, and start your adventures now! read more

Maximizing Credit Card Rewards

- Plan your travel: Strategically plan your trips to maximize credit card rewards, whether it’s redeeming points for luxurious hotel stays or stretching your miles for multiple flights.

- Stay Updated: Keep abreast of the latest deals and offers to make the most of your credit card rewards. Follow relevant sources on social media and online forums to stay informed.

The Best Travel Credit Cards In Canada for 2024, by Forbes

American Express Cobalt® Card

- An enticing welcome bonus valued at up to $300 awaits.

- Earn 5 Membership Rewards points for every dollar spent on groceries (up to $30,000 a year).

- Get 2 Membership Rewards points for each dollar spent on travel and transit.

- Enjoy versatile redemption possibilities for Membership Rewards points, including statement credits and transferring points to major frequent flyer programs.

- Benefit from comprehensive travel insurance coverage.

- Receive a $100 USD hotel credit valid for dining, spa services, or other leisure amenities at designated hotels.

Conclusion

Choosing the right travel credit card can significantly enhance your travel experiences and save you money in the long run. By understanding how these cards work, considering your eligibility and preferences, and exploring recommended options, you can embark on your travels with confidence and reap the rewards along the way.

FAQs for The Best Travel Credit Card in Canada

What is the best travel credit card in Canada?

In Canada, the optimal travel credit card is established on the basis of an assortment of factors, encompassing your travel preferences, spending habits, and the benefits you regard as most significant. The American Express Cobalt Card, the Scotiabank Passport Visa Infinite Card, and the TD Aeroplan Visa Infinite Card are, nevertheless, well-liked alternatives. Each of these cards provides distinct perks, such as significant welcome bonuses, travel rewards, access to airport lounges, and insurance coverage. To decide which card is ideal for you, you must examine its characteristics and analyze how they correspond with your travel objectives.

What credit score do I need to get a travel credit card?

Standard eligibility requirements for premium travel credit cards are a minimum credit score of 660 or 724. Individuals with lower credit scores are still able to earn rewards through the use of secured credit cards or prepaid alternatives that are tailored to their particular needs.

How do travel cards work?

Travel credit cards offer points or miles as a reward for routine and travel-related expenses; these points or miles can be redeemed for benefits including airfare and hotel accommodations. A wide range of card categories are available, encompassing airline, hotel, general travel, flat-rate, and premium cards, each of which provides distinct benefits and compensation frameworks. In order to redeem points for rewards, cardholders accrue them. This process can be completed via the online portal of the card issuer or, for greater flexibility, by transferring points to associate loyalty programs. Sign-up benefits, earning potential, annual fees, and additional rewards are all crucial aspects to consider when selecting a travel credit card.